A written promise to pay money at a later time by one party is known as a promissory note. Promissory notes are frequently used by other organizations or people to confirm the agreed-upon terms of a loan, despite the fact that financial institutions may issue them. Simply put, anyone can function as a lender thanks to a promissory note. You can get samples of promissory notes online.

What Information Is in a Promissory Note?

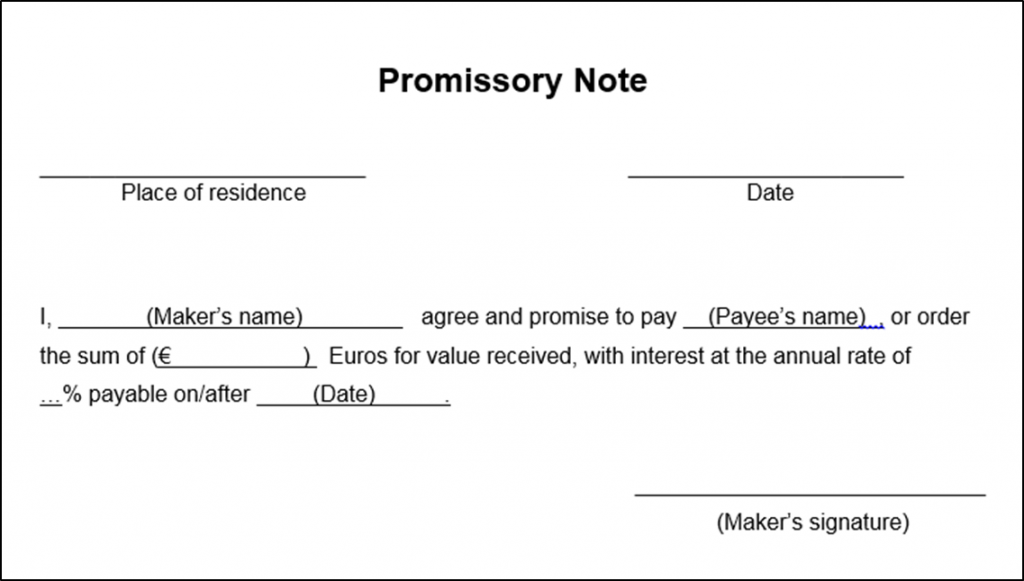

Promissory notes, a type of debt instrument, are written promises from the issuer to compensate another party. The parties’ agreed-upon terms, including the maturity date, principal, interest, and issuer’s signature, will all be included in a promissory note. In essence, a promissory note gives entities other than financial institutions the ability to lend money to other entities. When an organization is unable to obtain a loan from a conventional lender, such as a bank, a promissory note may be advantageous.

Promissory notes, however, can be much riskier because the lender lacks the resources and scale that financial institutions have. In the event of a default, legal issues might simultaneously arise for the issuer and payee. Therefore, having a promissory note notarized may be crucial. It is a type of debt instrument that contains a written promise from one party—the note’s issuer or maker—to pay another party—the note’s payee—a specific amount of money, either immediately or at a predetermined later date.

Although they may be issued by financial institutions—you might be required to sign one in order to obtain a small personal loan (for example, promissory notes typically enable businesses and individuals to obtain financing from sources other than banks). An individual or business that is prepared to carry the note (and provide the financing) under the specified conditions can serve as this source. A free promissory note template in Maryland can help you get an idea.

Promissory notes essentially give anyone the ability to act as a lender. Promissory notes fall somewhere between the informality of an IOU and the formality of a loan contract in terms of their ability to be enforced by the law. An IOU merely acknowledges the existence of a debt and the amount one party owes another, whereas a promissory note includes a specific promise to pay as well as the steps necessary to do so (such as the repayment schedule). Unconditional, negotiable promissory notes are used extensively in international business transactions.

Conclusion

The principal amount, interest rate, maturity date, date and location of issuance, and issuer’s signature are all typically included in a promissory note along with all other terms pertaining to the debt. A promissory note is typically held by the party who is owed money; after the debt has been completely paid off, the payee must cancel it and give it back to the issuer. Promissory notes are typically only given out to corporate clients and experienced investors in the United States. However, promissory notes are now also being used more frequently when it comes to buying and selling houses as well as securing mortgages.